Big Data

We are what we search, and how dominating sales paradigms vary over time and across cultures

We are what we search. This is the underlying assumption of this blog post. More precisely, we search for a specific term because we want to know more about this term, and we want to know more about this term because we are somehow new to a specific product, service, field, area, or discipline (hereinafter “field”). If including also the effect of professional updating by people already in the field, search term frequency can be seen as a function of the inflow of new people to a specific field, plus of the current number of people in the same field.

We are what we search. This is the underlying assumption of this blog post. More precisely, we search for a specific term because we want to know more about this term, and we want to know more about this term because we are somehow new to a specific product, service, field, area, or discipline (hereinafter “field”). If including also the effect of professional updating by people already in the field, search term frequency can be seen as a function of the inflow of new people to a specific field, plus of the current number of people in the same field.

We will in this blog post apply the above insight to the issue of studying how dominating sales paradigms vary over time and across cultures. We will specifically look at four generic sales channel paradigms: proactive direct sales, reactive direct sales, indirect sales, and sales through digital channels. To each of these channel paradigms we will identify a set of search terms that somehow are linked to the channel paradigm (but not to the others), and we will use Google Trends to measure search term frequency over time and across cultures. To check the robustness of the approach, I will also include some search terms with assumed general validity across sales paradigms.

The cultural specificity of a search term was calculated as sum(fi^2)/sum(fi)^2, where fi is search term frequency for country i. This index is always between 0.0 (highly fragmented) to 1.0 (all searches from one country). This index is related to the so-called Herfindahl index for measuring market concentration.

For studying trends, we used the time period January 2004-April 2015, unless otherwise specified (see rightmost column in table below). For studying cultural differences, we used the time period May 2012-April 2015.

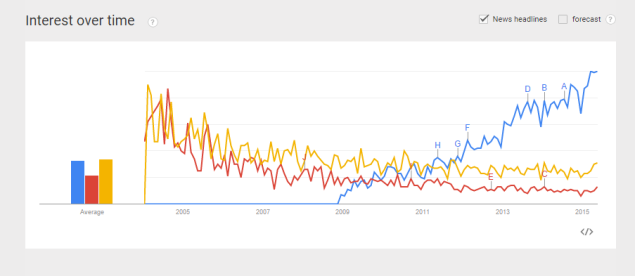

Here is an example of typical output from Google Trends for search trends (blue = ‘inbound marketing’, red = ‘solution selling’, yellow = ‘spin selling’):

Here is an example of typical output from Google Trends for geographical distributions of search terms:

Here is what we found, for the above four sales paradigms and with 2-5 search terms per sales paradigm (X = start growth rate calculation, see right column):

| Sales channel paradigm | Search term | Annual growth rate X-2015 | Cultural specificity | In case specific, territory | Start growth calculation |

| Proactive sales | Cold calling | -5,0% | 0,19 | British Empire | Jan 2004 |

| Spin selling | -6,6% | 0,34 | US, UK, India | Jan 2008 | |

| Relationship selling | -9,3% | 1,00 | US | Oct 2008 | |

| Sales training | -12,6% | 0,13 | Jan 2004 | ||

| Solution selling | -13,3% | 1,00 | US | Aug 2010 | |

| Reactive sales | Inside sales | 3,6% | 0,30 | Jan 2006 | |

| Account management | -2,0% | 0,10 | Jan 2004 | ||

| Indirect channels | Distributor | -6,4% | 0,05 | Jan 2004 | |

| Reseller | -9,7% | 0,06 | Jan 2004 | ||

| Value added reseller | -15,2% | 1,00 | US | Jul 2004 | |

| Software reseller | -17,2% | 1,00 | US | Mar 2007 | |

| Digital channels | Inbound marketing | 34,3% | 0,15 | Oct 2009 | |

| Social media marketing | 27,0% | 0,07 | Jun 2008 | ||

| SEO | 10,3% | 0,02 | Jan 2004 | ||

| Adwords | 11,2% | 0,02 | Jan 2004 | ||

| Paradigm-neutral terms | Interpersonal skills | 3,8% | 0,09 | Jan 2004 | |

| Objection handling | 0,2% | 1,00 | UK | Mar 2008 | |

| Negotiation skills | -4,5% | 0,26 | Jul 2006 |

Here are key conclusions:

- The importance of proactive sales channels is globally decreasing with 5-15% per year, and hunter-style selling is becoming more and more a US and UK skill set.

- Selling through indirect channels, like distributors and resellers, is also decreasing by 5-20% per year. However, if one looks beyond the numbers presented above, one will see that indirect sales is actually on the increase in a number of Asian countries. This is consistent with lower barriers to trade in these countries, and a need to build distributions systems in previously locally served or under-served markets.

- Manual, reactive selling is generally stable, with -5% to 5% annual frequency increase. This is somewhat strange, as one would assume that many reactive sales activities are being migrated to lower cost, better service digital channels, including pure self-service portals. It could have to do with the professionalization of inside sales / account management.

- Digital channels are rapidly becoming the dominant sales paradigm, with a 10-35% annual increase in search frequency. As expected, there is no particular search concentration, and Spain is for example on top for search term ‘inbound marketing’. However, some digital channels, say inbound marketing, require significant technology sophistication, which is mostly found in mature economies.

- Search term frequency for assumed paradigm-neutral search terms is generally stable over time, as expected. There is however significant cultural specificity, which is just a reflection of the fact that most such terms tend to be language specific.

There are a number of issues with the above methodology:

- The selected search terms are either abbreviations or in English language. It means that similar searches in other languages have not been included in the analysis. Example: ‘cold calling’, which translates into a roughly similar term in Spanish, ‘venta por teléfono’. The effect is to over-weigh Anglophone countries this study.

- Search term frequency is an unknown function of both inflow and level. Even with zero inflow of new practitioners, a channel paradigm could still live on for many years (until all the practitioners have left the profession, retired, or deceased). In a way, why would a 40-year old successful spin selling expert Google ‘spin selling’? Search term frequency could therefore be seen as a leading indicator, but not an accurate indicator.

- Google Trends has a number of issues, including a normalization (i.e., absolute numbers are unavailable), temporal gaps (when search term frequency falls below a Google-defined threshold), and sensitivity to specific search terms.

- It could be argued that conclusions regarding a specific sales paradigm depend on the specific search terms chosen for inclusion. This appears generally not to be the case.

- When we are using Google Trends, we are looking at the world descriptively, not how it prescriptively should be, based on KPIs like win probability, revenue growth, RoI, or NPV.

But in general, no big surprises, and conclusions resonate reasonably well with most anecdotal evidence.

The interesting part of my story starts when we dig into some of the underlying issues that my analysis brings up. Just some examples:

- Could we use Google Trends as a general tool for market predictions and / or market sizing exercises? Hypothesis: Yes, and my guess, just as an example, is that a 12,6% annual reduction in the interest in sales training translates directly into a roughly 10-15% annual reduction in the sales training market.

- What is the accuracy of Google Trends analyses compared with say case studies and various survey instruments? Hypothesis 1: Wrong question, conducting such interviews or surveys in a large number of countries over an 11-year time period would have been extremely costly and beyond the reach of most or all organizations. Hypothesis 2: Competing approaches would have methodological issues of their own.

- Is the sales community moving into a scenario in which proactive sales initiatives with excellent RoI or NPV will not be undertaken because shortage of hard-core sales talent and / or us being deluded by all this digital channels hype? Hypothesis: Yes.

- Where to go if one really wants to learn the tools of the trade of hard-core sales, the hunter way (or to source the same type of sales talent)? Hypothesis: Stay away from Continental Europe (they have never been good at it anyway), and look to UK, Australia, Canada, US, India, and South Africa. If in Europe, go the Netherlands or Germany.

But whether you are a management consultant endeavoring to analyse trends in a specific market, or a senior sales executive trying to identify, qualify, and hunt down massive deals, my message is this: We are what we search, and you ignore search as a most fundamental activity in any sales or purchase process at your peril.

Grim

Thank you for yet another brilliant little gem of insight, Grim! You are as always very interesting, inspiring, and with crystal-clear trains of thought. I thoroughly enjoyed this.

LikeLike